7 Tips For First-Time Homebuyers In Nigeria

August 11, 2023

August 11, 2023  0 Comments

0 Comments

7 Tips for First-Time Homebuyers in Nigeria

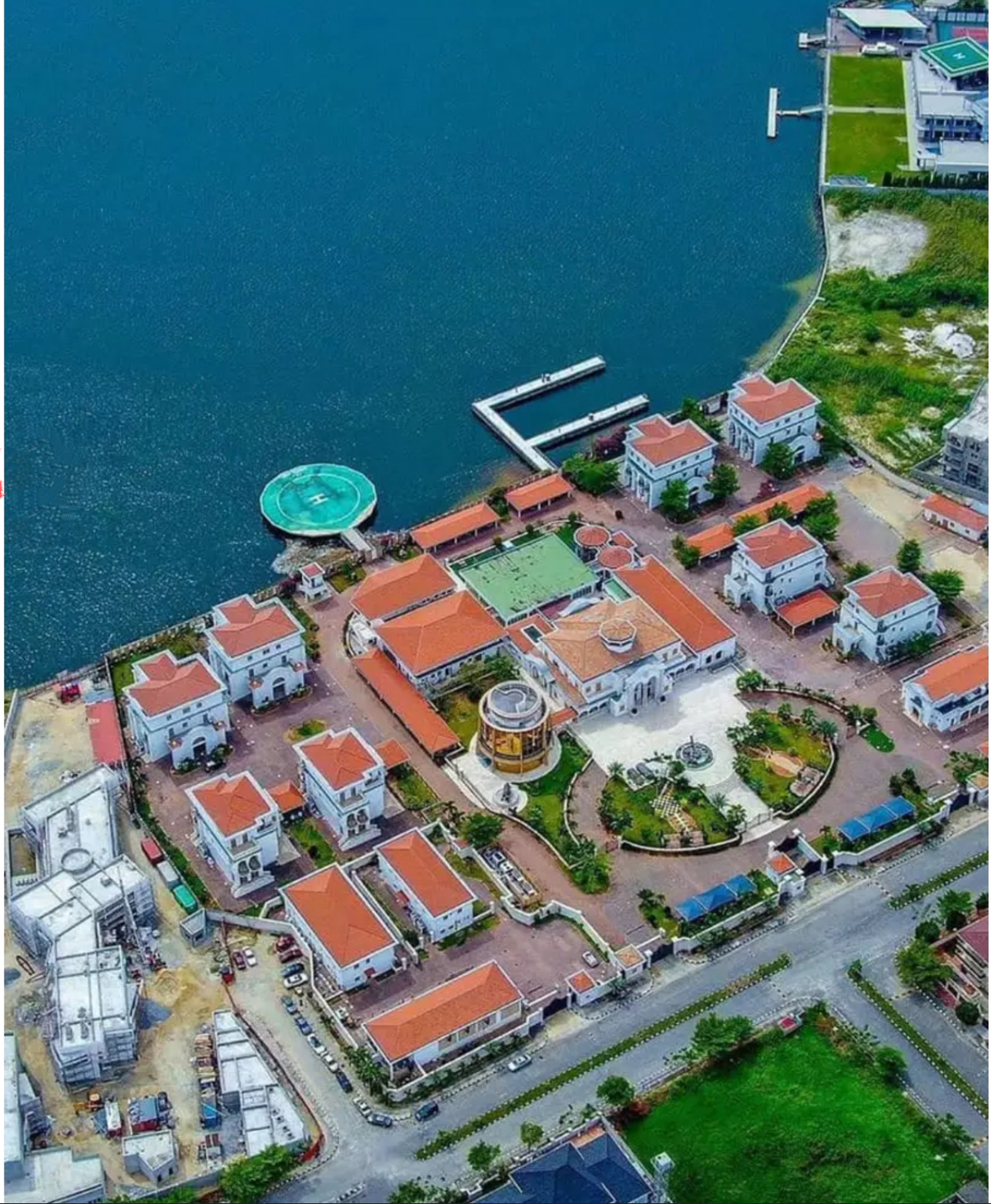

Buying a home for the first time can be an exciting but overwhelming experience. Owning your own home is a dream of millions. It gives you the satisfaction of owning something which you can call yours. It gives you the security of a roof over your head. But buying your first home is not an easy process. So in this post we'll share seven tips to help first-time homebuyers navigate the real estate market and find their dream home. These tips include:

1. Setting a realistic budget: some cities can be expensive to buy a home in, so it's important to set a budget that you can realistically afford. Don’t make your agent’s job more difficult by setting unrealistic targets or restrictions.

2. Do your Research: You might be in a large city with many different neighborhoods to choose from. Researching the different areas and finding one that fits your lifestyle and needs is key.

3. Working with a reputable real estate agent: A good real estate agent can help you navigate the real estate market and find homes that fit your criteria.

4.Control your emotions. Emotions can cloud judgment. Allow your agent to make informed decisions and provide guidance on the eventual decision and be open to receiving advice.

5. Getting pre-approved for a mortgage: Getting pre-approved for a mortgage can help you understand how much you can afford to spend on a home and make the buying process smoother.

6. Being patient: The real estate market can be competitive, so it's important to be patient and not rush into a decision.

7. Negotiating the Price and Close the Deal:

You might not be a negotiation shark if you don't happen to be an attorney, mediator, union rep...or a real estate agent. We Have Superior Negotiating Skills It's our job to get you the best possible price for your home, or to see to it that you get the best possible deal on the property you want to buy.

With these tips, first-time homebuyers in can feel confident and prepared as they embark on their home buying journey.

Leave a Comment