What Is Joint Ventures And How It Works In Real Estate Industry

September 10, 2023

September 10, 2023  0 Comments

0 Comments

What is a joint venture?

joint venture (JV) is an arrangement between two or more parties where value is created from the development, acquisition and management of a property.

This alternative property investment enables experienced investors to work alongside property developers to combine capital with industry expertise.

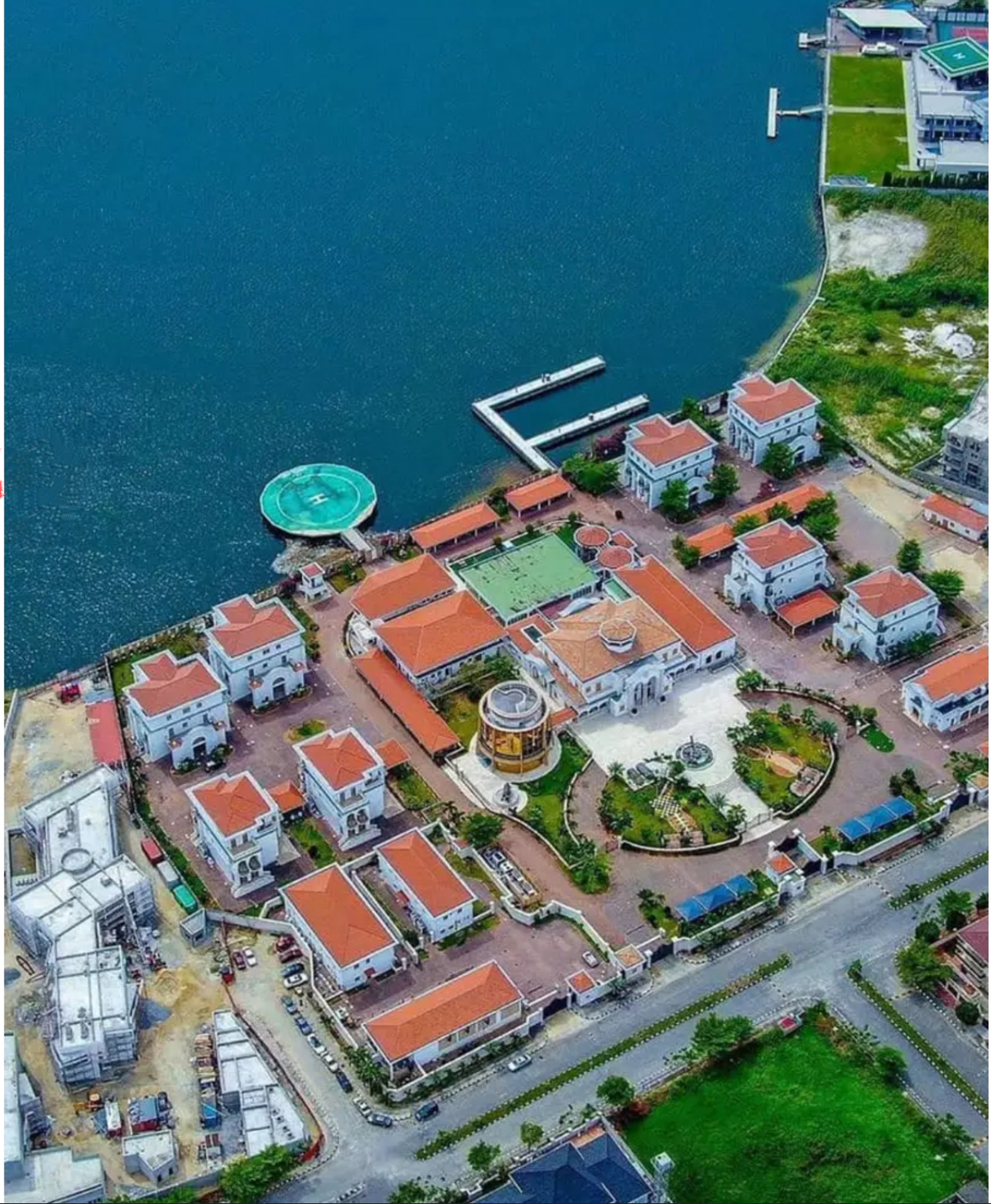

Contributing to the delivery of a range of property projects, directly addressing the excess demand for housing in the Nigeria and Africa and generating significant financial returns can each be achieved through JV real estate opportunities.

Typically, real estate JVs are devised to deliver residential and commercial development projects or mixed-use schemes. Some can be large-scale regeneration projects involving multiple partners, whilst others can be smaller projects with fewer investors.

To get the best of real estate as an investor you need to diversify your portfolio. Real estate investing, in most cases are perceived as a solitary endeavour but the hidden gem, which is Joint Venture can bring remarkable advantages.

The fundamentals of Joint Ventures is that- it’s a business agreement between the landowner and a developer to combine their assets and skills to develop a property project.

Benefits of Investing In Joint Ventures:

Real Estate in Joint Ventures can offer the potential that investing as an individual might not be able to achieve. Joint Ventures can be a good investment opportunity for the following reasons:

Shared Risks and Costs:

Joint Ventures allow investors to share the costs and risks by reducing the investor’s exposure to potential losses and increase their chances of success.

Access to Expertise and Resources:

Joint Venture allows investors to pool their expertise and resources with the other party, which can lead to more effective decision-making and better outcomes.

Access Markets:

Joint Ventures can be beneficial to developers that are looking to expand into new markets geographies. By partnering with other developers, both parties can access local knowledge, networks and resources which can help navigate the business.

Flexibility:

Joint Ventures can be structured in a way that best suits the needs and objectives of the investors, allowing for greater progress with the proposed project.

Things to Consider Before Investing in a Joint Venture

Partnership Selection:

Choosing the right Joint Venture partner is crucial to its success. Having a partner with complimentary skills, a good reputation and a good track record is perfect for business. Do your due diligence before going into Joint Ventures with an investor or a developer.

Market Research:

Before investing in any Joint Ventures, it is important to conduct thorough research on the market conditions and the demand for the type of property you are considering to have on the land. Conduct your market analysis based on market trends, your projected ROI and investment goals.

Legal Considerations:

Joint Ventures involve complex agreements, so it’s important to work with a lawyer that is experienced with Lagos real estate and importantly, real estate Joint Ventures. This is to ensure that your interest is protected.

Risk Management:

Joint Ventures involves risk, so it is important to have a risk management plan to minimize potential losses regardless if you are an expert realtor or an experienced real estate developer.

Financial Options:

Joint Ventures often require significant financial options, ensure that you have what it takes to cover your share of the investment.

People that Invest in Joint Ventures:

The people who invest in real estate JV can include:

(1) Real Estate Developers

(2) Individuals

(3) Private Equity Firms

(4) Institutional Investors

(5) Real Estate Investment Trusts

The people who invest in real estate JV are typically looking to share the costs and risks of a real estate projects, potentially earn a return on their investment and diversify their portfolio.

What experience does the property development team have?

The successful delivery of a property JV requires an experienced team with a demonstrable track record. When considering an investment of this nature, it is strongly recommended that time is taken to understand the capability of the project team and investment team.

Looking into previous or current developments could offer one route of researching the ability of the property team and their extent of industry experience.

How Joint Venture Work in Nigeria.

If you are wondering how Joint Ventures work in Nigeria, it typically involves two or more parties who have agreed to set up a Special Purpose Vehicle (SPV) for a specific purpose, such as a housing development or commercial building. The SPV registered with Corporate Affairs Commission, is a subsidiary created by the parent company or Joint Ventures investors to isolate financial risks.

The parties agree on a profit-sharing mechanism based on an agreed Return on Investment model, and a Shareholders Agreement is created to govern relationships between shareholders and the SPV.

However, it is important to note that Joint Ventures carries some downsides, such as a potential for disagreements between partners, the complexity of managing a joint enterprise, all of which can be managed through due diligence and legal backings.

Conclusion

Every potential or aspiring investor or land owner should ensure they conduct due diligence .

Leave a Comment